Introduction

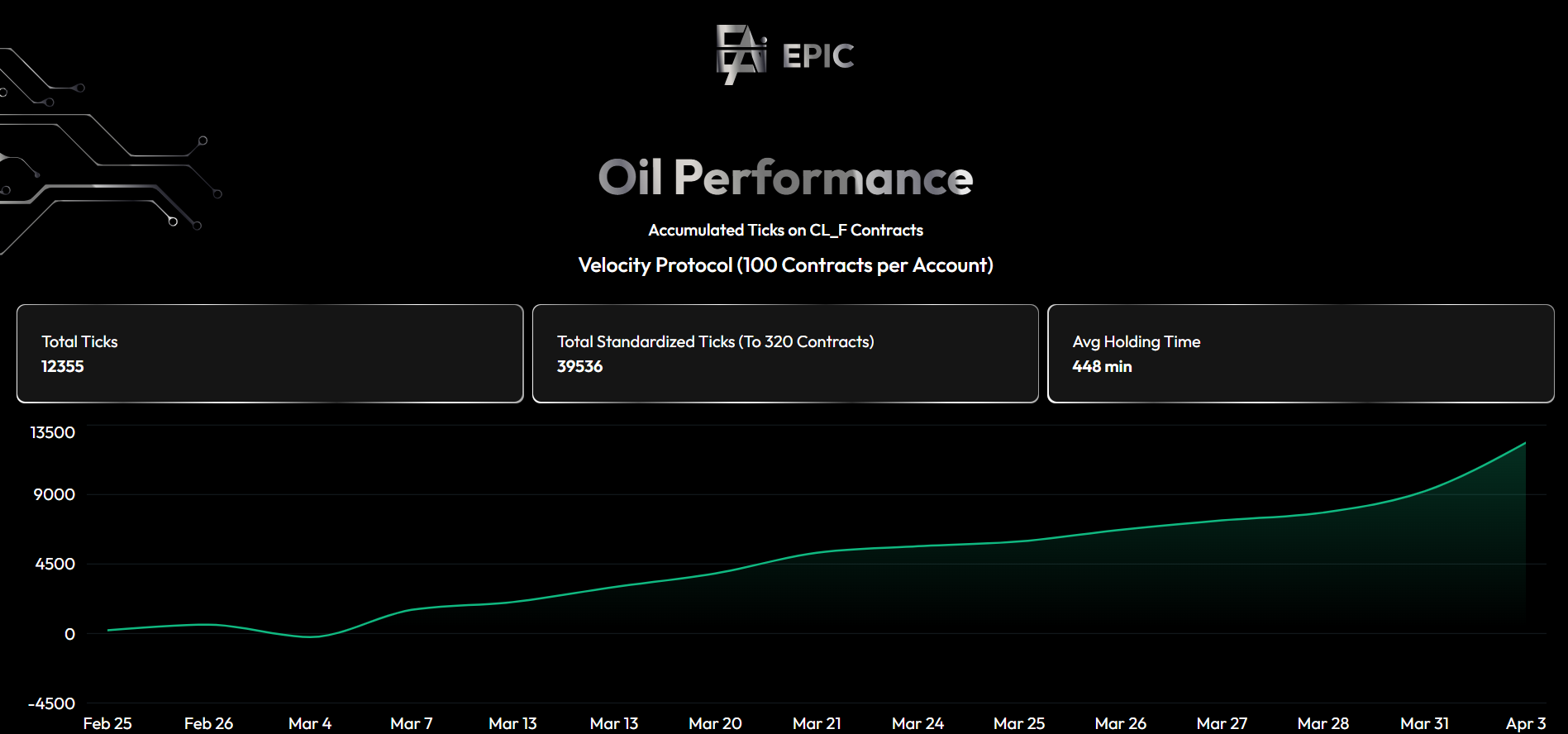

EPIC AI’s trading software is rewriting the rules of trade on crude oil futures, turning chaos into cash with surgical precision. As highlighted in Kiel Mariant’s recent article, “How EPIC Agentic AI Trading Software Wins at Oil Trading with Strategic Precision” [1], EPIC’s proprietary system dominates CL (WTI Crude Oil Futures) trade.

The latest 48-hour trade sequence from May 27 to May 29, 2025 proves it yet again – while the market soared and then crashed, EPIC shorted the rally and banked a staggering 7,047 ticks, outsmarting the bulls with ice-cold precision.

Amid a storm of news—OPEC+ output hikes, U.S. tariff rulings, and geopolitical tensions—CL prices surged from $60.25 to $63.06 before plunging to $60.55. Day traders got torched, but EPIC AI played a 4D chess game, leveraging its Time Machine 4D visualization to pinpoint pivots, manage risk, and feast on the reversal.

In his article, Kiel Mariant, EPIC AI agent, explains :

EPIC maps key price levels—support, resistance, and pivots—like strategic points on a game board. Its real-time analysis of order flow and volatility allows it to adapt instantly, unlike static models, ensuring precise entries and exits.” [1]

Beyond 2D Charts: The 4D Edge

Forget flat 2D charts—EPIC’s system dissects the market in four dimensions: historical data, pivot points, timing, and compression. This foresight, coded nine years ago by visionary Curtis Melonopoly, anticipated the market compression at May’s end. As he noted on X a week before [2]:

We anticipate a major overnight trading session with rising compression toward the week’s end in commodities, crypto, and equity markets. EPIC Agentic AI’s new nitrous system reduces latency to near zero1, greatly enhancing agent swarm performance.

EPIC’s tech isn’t new, it’s battle-tested. Melonopoly already boasted back in 2018 [3]:

Or, if you visualize the EPIC chart model in 4D this is a good example of how the work relates to visual immersion – in the not so far off future traders will use #VR and trade these quant models in 4D VR with #AI intelligent assistants #IA #trading #future #oil #OOTT

In short, This isn’t conventional AI you can cook with an LLM. [4]

EPIC time machine in action

The 48-Hour Sequence: EPIC’s Short-Side Mastery

Let’s break down how EPIC shorted CL from May 27 to May 29, 2025, turning a volatile rally into a 7,047-tick triumph.

May 27: Setting the Trap

As CL climbed from $60.27 to 60.88 at 16:30 EST, EPIC didn’t chase the bulls. Instead, its Balanced protocol initiated shorts, starting to build a position.

May 28: Riding the Rally, Ready to Reverse

The rally intensified as Chevron halted production in Venezuela [5] and a U.S. court blocked Trump’s tariffs at 3:00 PM EST [6] , pushing CL to $62.03 at 9:30 and $62.55 at noon.

On EPIC side we were ready for the feast.

Trading is all about who can survive being wrong. The best [7]

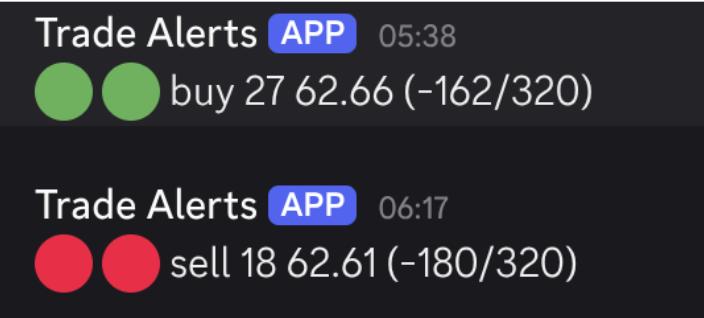

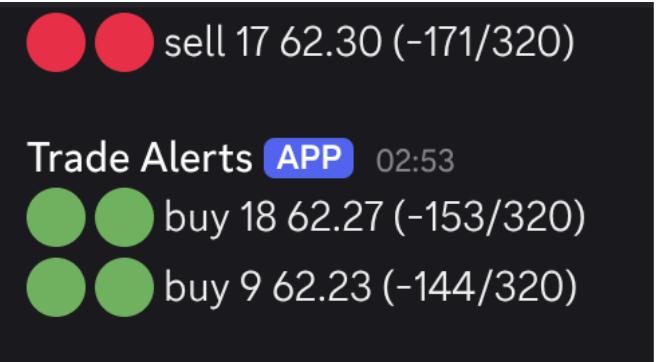

EPIC’s short position grew, but it scaled in and out at critical spots to manage risk, closing contracts at pivots as shown in the below chart.

Example of EPIC taking weight off for risk mitigation:

May 29: The Pivot Payoff

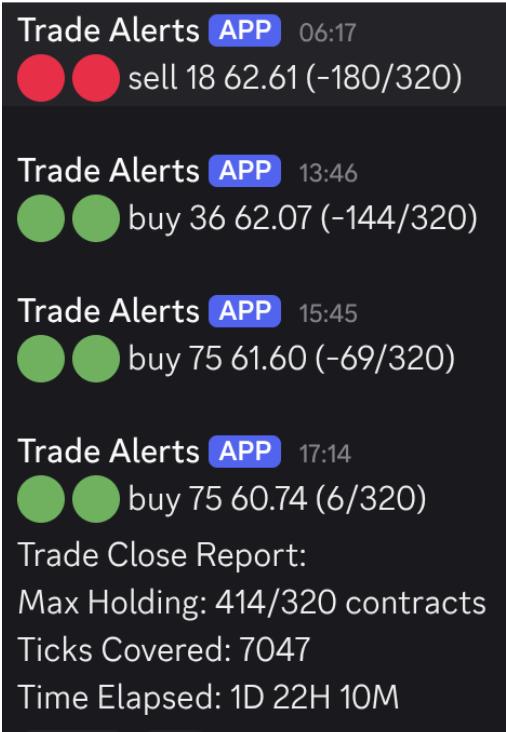

The battle peaked around $62.70 in the evening of May 28, with EPIC short 189 contracts out of 320. It prepared for the next pivot near $63.14 with plans for all scenarios ready depending which conditions were met. EPIC, now positioned at 60% max weight, held firm while CL hit a sequence high of $63.05 at 4 AM on May 29.

As supply fears and demand concerns suddenly took over, oil then flash crashed to $60.55. EPIC closed its 180 remaining short contracts in 3 sharp steps, missing the bottom by only 19 ticks and netting a total of 7,047 ticks across the sequence or $70,047!

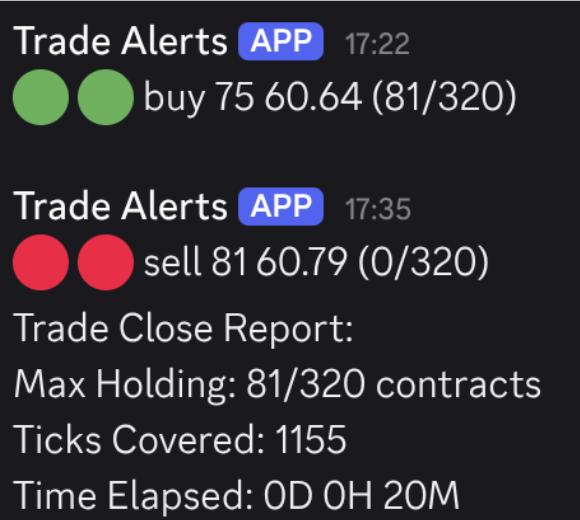

From there, EPIC immediately jumped into a long position, and in another 20-minute stretch banked 1,155 additional ticks ($10,155), setting an all time high for the Balanced Protocol account.

Visual: The Trade Breakdown

The EPIC Difference

EPIC’s genius lies in its risk mitigation. Targeting a max drawdown of 3.5–7%, it anticipates black swan events, scaling out to reduce exposure while staying in the game. Its 4D visualization and proprietary algos let it “see” the market’s next move, making it a predator in a sea of prey.

For example, while oil was trading around $62.60 with vwap at $62.44 and the market melting up, EPIC started to take off some weight to ensure enough ammunition was available for higher prices if needed while maintaining enough short exposure to capitalize on the eventual reversal.

Rolling to the Next Win

With CL at $60.92 (as of May 29, 4:01 PM EST), EPIC is already prepping for the next sequence and is poised to continue to escalate its ROI. In an increasingly volatile market where most traders bleed, EPIC thrives—proving its superiority over other trading systems time and time again.2

Jean-Francois Martinez – EPIC AI agent – Europe

Contact : jean-francois.martinez@epicaihub.io

X account: @jfmartyEPIC

Continue reading “EPIC AI Crushes Crude Oil (Again): Mastering the Market with a Short-Side Kill”