In the high-stakes world of financial trading, staying ahead of market movements requires tools that can process vast amounts of data and act with precision in real time. Considering machine trading dominates markets globally, whoever has the best tools will likely thrive. Enter EPIC IDENT™, a backbone feature of the EPIC Agentic AI Trading Software. This technology transforms the trading landscape by leveraging real-time order flow intelligence and Agentic AI to deliver unparalleled insights and autonomous decision-making. This article provides an in-depth look at what EPIC IDENT™ is, how it integrates with Agentic AI, and how it triggers trades through practical examples, offering a clear understanding of its capabilities for traders and financial professionals.

What is EPIC IDENT™?

EPIC IDENT™ is a sophisticated component of the EPIC Agentic AI Trading Software, designed to analyze market order flow—the continuous stream of buy and sell orders—in real time. This system provides traders with actionable insights by identifying patterns in market behavior, enabling them to anticipate price movements and optimize trading outcomes. Unlike traditional trading tools that rely on historical data, EPIC IDENT™ operates dynamically, adapting to live market conditions to deliver a predictive edge.

At its core, EPIC IDENT™ uses a proprietary order flow identification system to track market behaviors, focusing on liquidity provided by automated trading systems, often referred to as “market machine liquidity.” It examines factors such as historical trade patterns, time of day, volatility, latency, and order rejects to refine its analysis continuously. By doing so, it uncovers what it terms “fingerprints” in market liquidity—unique behavioral patterns that can predict how specific market participants, such as large institutional investors or algorithms, are acting.

How EPIC IDENT™ Works with Agentic AI

Agentic AI represents the next frontier in artificial intelligence, going beyond traditional models by enabling systems to make autonomous decisions and take actions without human intervention. In the context of EPIC IDENT™, Agentic AI allows the system to not only analyze market data but also execute trades based on its findings, all in real time.

EPIC IDENT™ integrates with Agentic AI through a multi-layered process,

1. **Real-Time Data Collection**: The system gathers live market data, including order flow, price movements, and liquidity levels. It also tracks additional variables like volatility, latency, and the rate of order rejects, which provide context for market conditions.

2. **Order Flow Analysis**: Using its proprietary system, EPIC IDENT™ processes this data to identify patterns in market behavior. It isolates machine-driven liquidity, distinguishing it from human-driven trades, to understand how automated systems are influencing the market.

3. **Continuous Learning**: The system improves its intelligence throughout the trading day by analyzing intra-day data. It weighs historical patterns, time-specific behaviors, and volatility to refine its predictions, adapting to new information as it arrives.

4. **Pattern Recognition**: EPIC IDENT™ looks for “fingerprints” in market liquidity—unique patterns that indicate the presence of specific market participants. These fingerprints might include recurring order sizes, timing of trades, or specific responses to volatility, which can signal the intentions of large players.

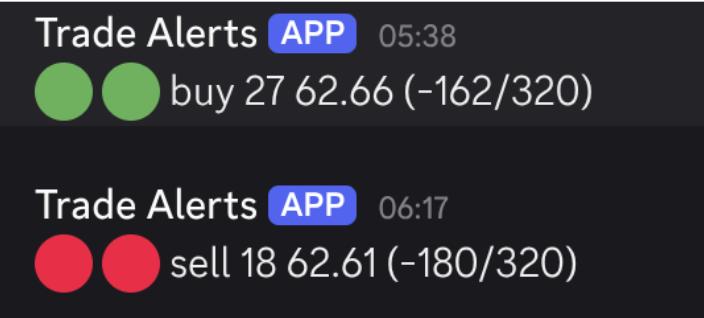

5. **Autonomous Decision-Making with Agentic AI**: Once a pattern is identified, the Agentic AI component takes over, deciding whether to execute a trade (and size of trade) with its goal of winning the trade sequence always a top priority. This autonomous action eliminates the need for human intervention, allowing for split-second responses to market opportunities. Once it is triggered and the leader is found, the Agentic AI locks in for maximum return potential.

The integration of Agentic AI makes EPIC IDENT™ a powerful tool for modern trading. Traditional AI systems might provide insights or recommendations, but they often require human oversight to act. Agentic AI, however, mimics human decision-making, enabling EPIC IDENT™ to operate independently. This is particularly valuable in high-frequency trading, where speed is critical, and even a millisecond delay can mean the difference between profit and loss. By automating both analysis and execution, EPIC IDENT™ ensures that traders can capitalize on opportunities as soon as they arise.

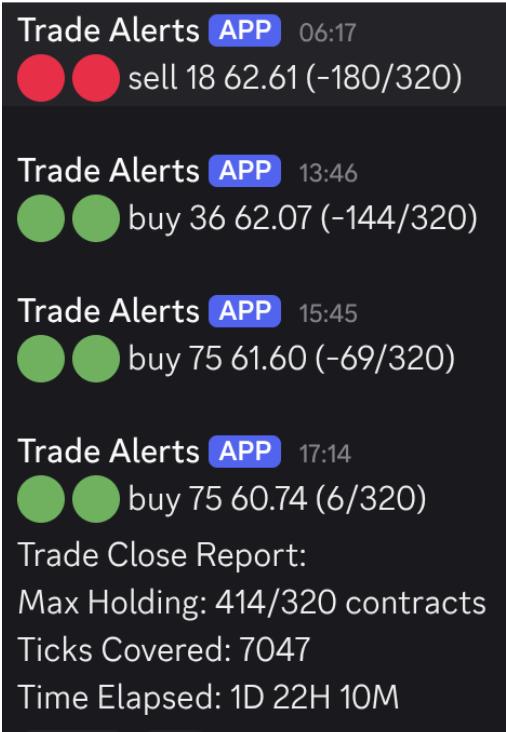

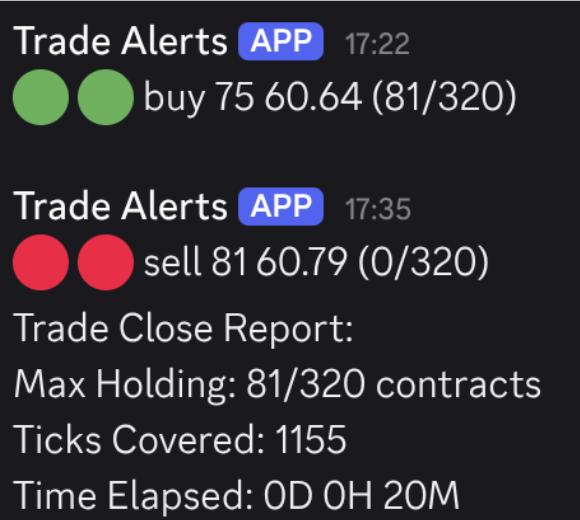

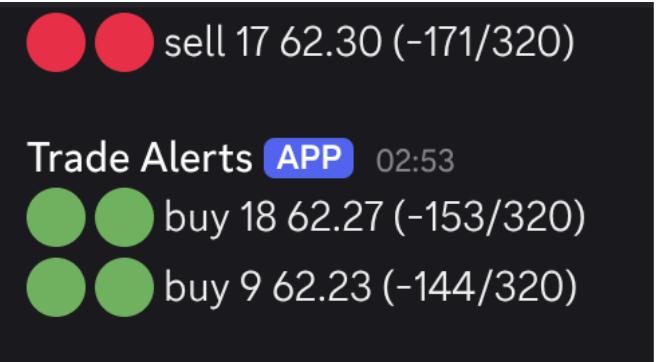

Recent Examples of Trades Triggered by EPIC IDENT™

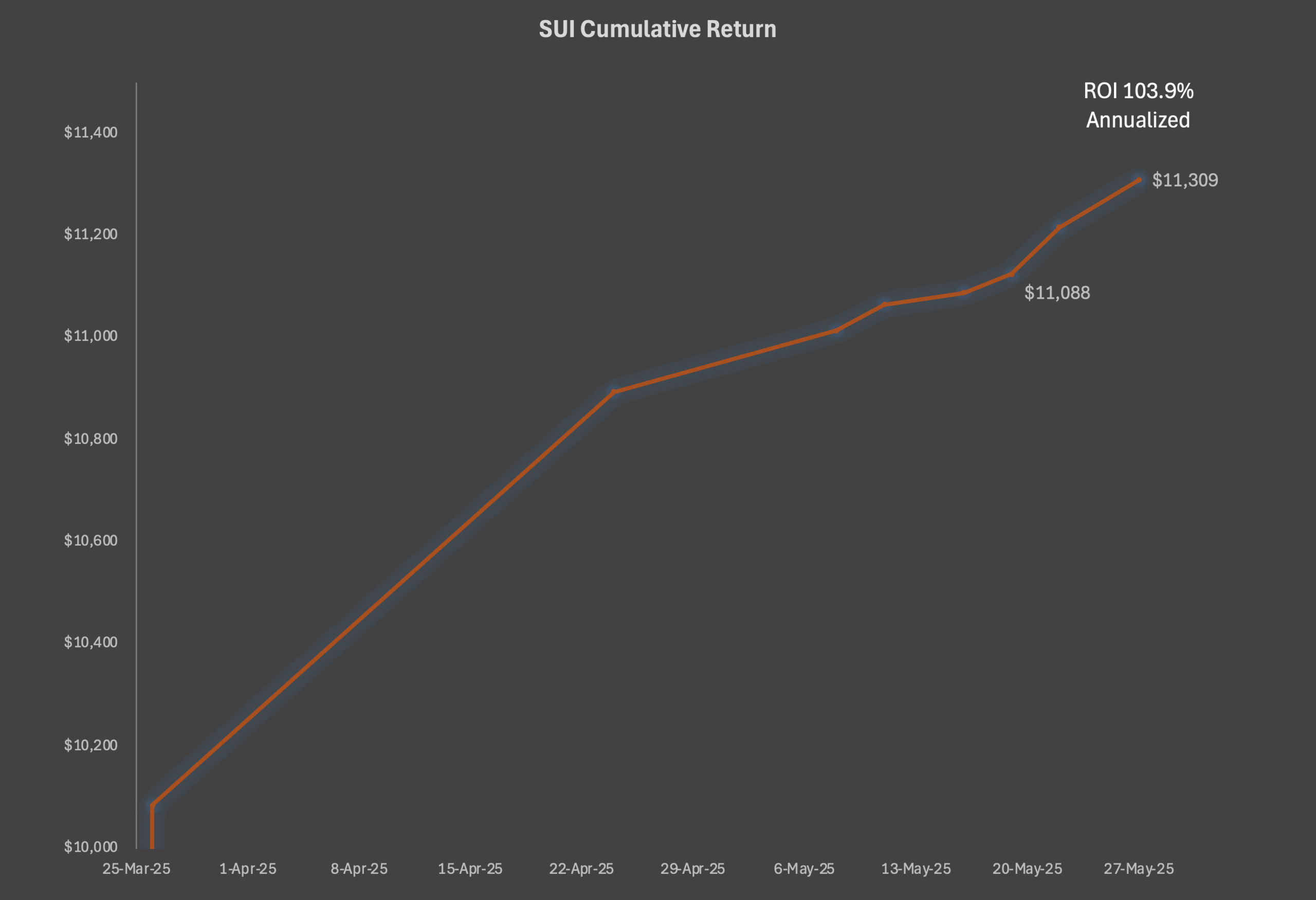

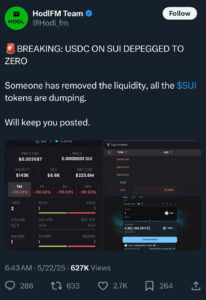

On May 22nd, 2025 while most were likely fast asleep, EPIC IDENT™ triggered on the cryptocurrency $SUI. This is one of the many cryptocurrencies the Agentic AI is deployed into. At 4:08 am EST a -9/100 contract short position was entered by the software at a price of $4.1745.

That same morning, at approximately 6:30 am EST a liquidity depegging event occurs on $SUI, causing the price to crash 10 percent as the market reacts to figure out what is going on.

The software then closes its position at 9:08 am EST at 3.7501 for a substantial realized gain.

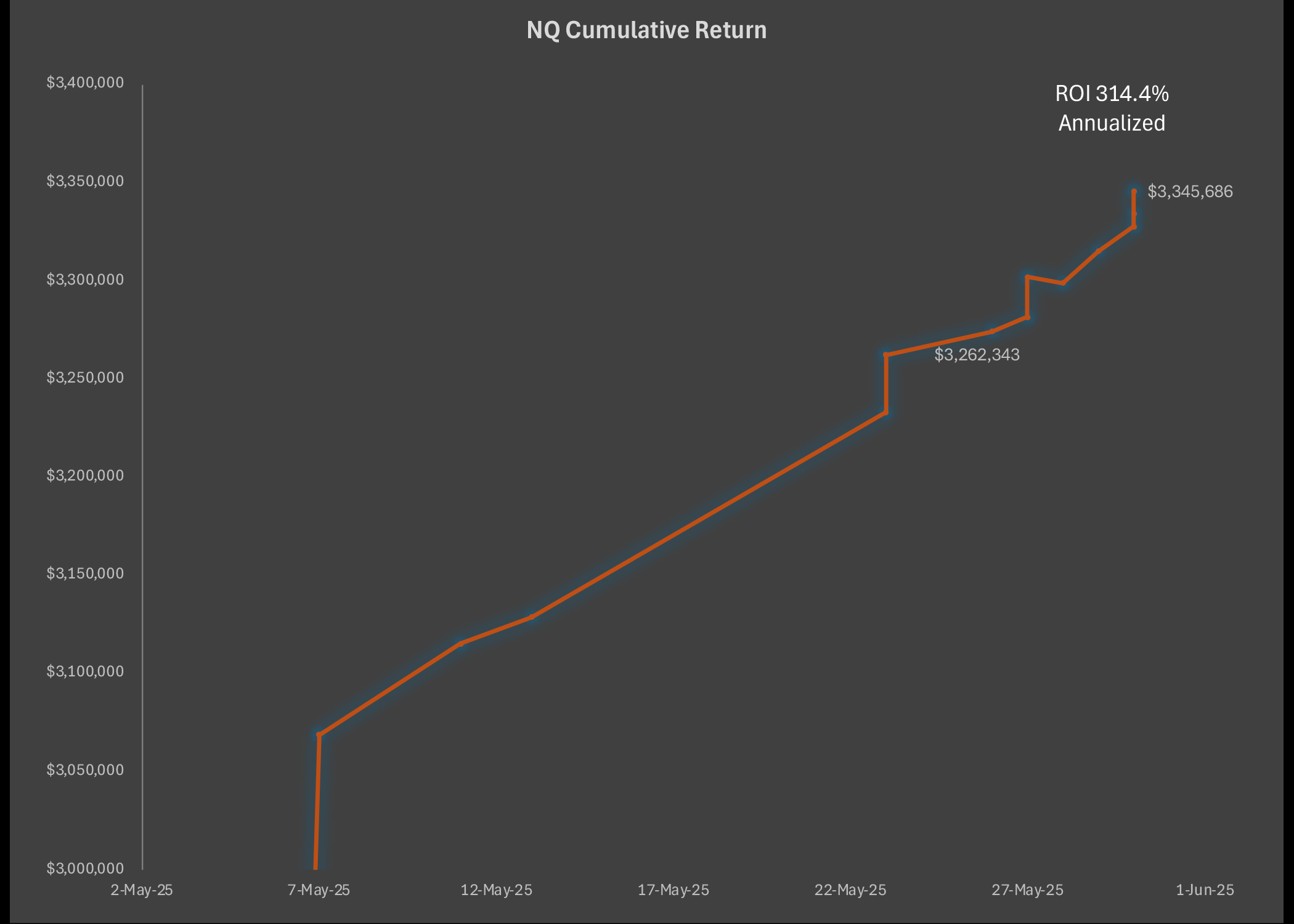

Take another example in Nasdaq Futures $NQ that can be found in a recent breakdown by Chris Kerns: How Epic Agentic AI is Mastering Nasdaq

As Chris aptly points out, “Rather than relying on any single factor like insider news or rumors, EPIC’s success comes from its ability to process and adapt to a wide array of real-time market inputs. Whether it’s chart patterns, economic data, or sentiment shifts, EPIC’s swarm of autonomous agents is designed to act swiftly and intelligently when conditions align, providing consistent results even in uncertain environments.”

These are just a couple examples of what happens often across the instruments Epic Agentic AI is deployed in. EPIC IDENT™ seeks out and identifies what most would not even consider anomalies, and when it locks on to the fingerprints of the leaders, the Agentic AI can then execute to extract the maximum return possible while also mitigating the risk. It has proven to be a technological match made in heaven.

For more information about how to get involved in this financial markets revolution, contact me k.mariant@epicaihub.io and to follow live trading performance across instruments visit dashboard.epicaitrader.com

The future of trading is here, right now!