Key Expectations for Performance:

EPIC Agentic AI Oil Trading Software

To help you navigate market volatility with confidence, this document outlines the key performance expectations and insights into the trading approach of the EPIC Agentic AI Oil Trading Software. Understanding these principles will prepare you psychologically for the journey ahead and align your perspective with EPIC’s long-term strategy.

Position Trading Principles

EPIC employs a position trading strategy, utilizing multiple entries and exits to build optimal positions when trading in trending markets. This approach enables EPIC to capitalize on market trends by gradually scaling into positions and dynamically adjusting as market conditions evolve. While it may seem counterintuitive—particularly when EPIC takes positions that appear to oppose a market move—this is an intensely calculated method. The AI optimizes the probability of success by managing trades to minimize risk and maximize gains over time, even in volatile or adverse market conditions.

Cyclical Nature of Trading

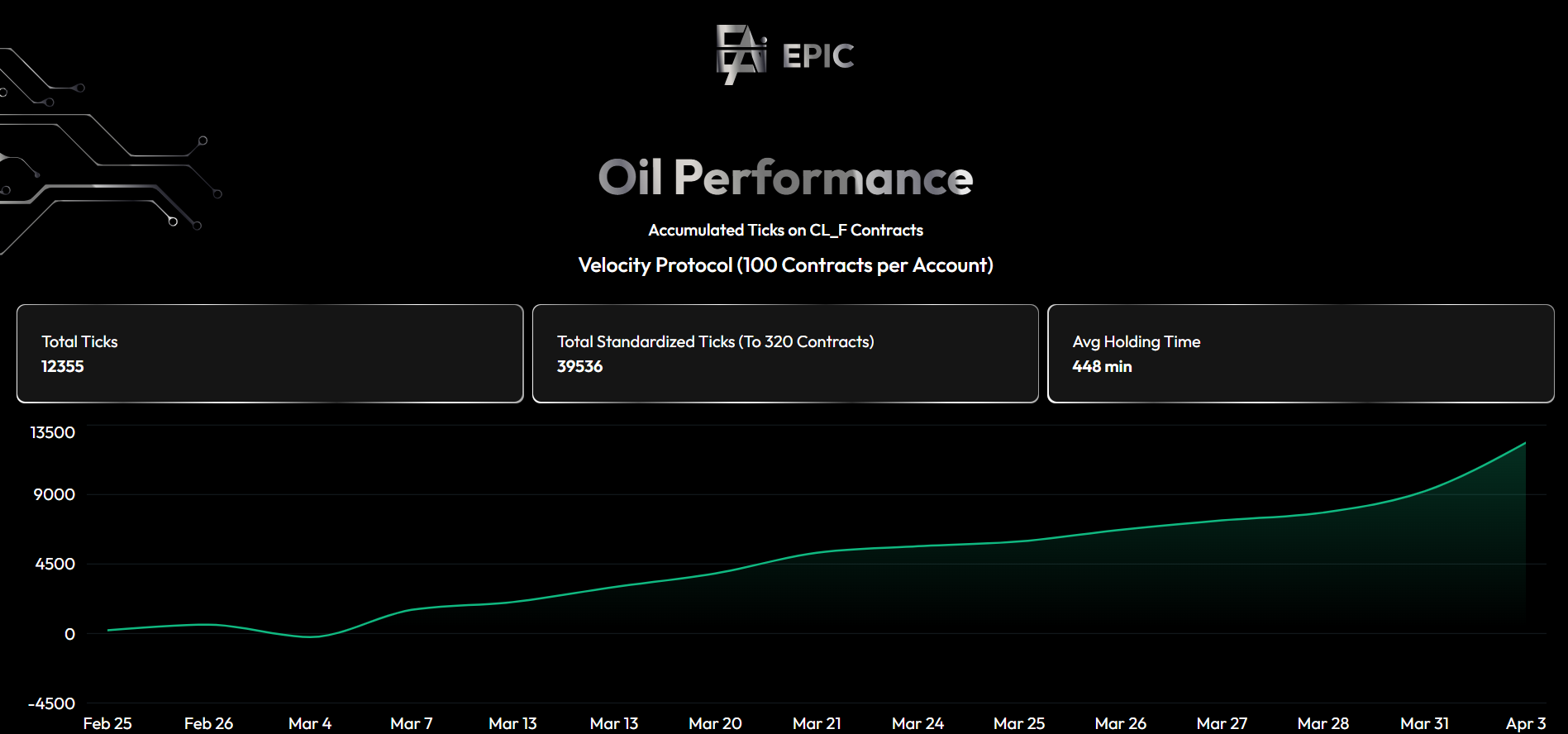

EPIC’s trading performance follows a cyclical pattern driven by its continuous AI learning, development, and the inherent cyclical nature of markets. The software is designed to push the boundaries of profitability, often resulting in a parabolic-shaped returns graph during periods of aggressive trading. This occurs as EPIC optimizes its strategies to maximize gains within a cycle. However, when the system reaches the limits of a cycle, it may encounter its largest losses, as the AI tests the boundaries of market conditions. Following such periods, EPIC reduces its aggressiveness, recalibrates, and begins a new cycle of growth. This adaptive process reflects the software’s ability to learn, improve, and push the limits of what is possible.

Additionally, markets themselves exhibit a cyclical nature in terms of the structures and order flows that EPIC relies on to achieve its elite level of success. When these market structures and flows are intact, EPIC can dominate with outsized wins, leveraging its AI to capitalize on optimal conditions. During periods when market structure and order flow are less than ideal, EPIC may experience losses or adopt a more conservative approach, effectively taking the foot off the gas while waiting for favorable conditions to return. Through all market cycles, EPIC’s best-in-class risk management ensures that potential downsides are carefully controlled, protecting your account while positioning for future opportunities.

Implication for Account Management: When deciding when to start accounts or add or remove funds, consider both EPIC’s internal trading cycles and the cyclical nature of market conditions.

Periods of parabolic gains or strong market structures may be followed by drawdowns or quieter phases, while recalibration periods may offer more stable entry points. Staying mindful of these cycles can help you align your account decisions with EPIC’s dynamic behavior.

Drawdowns Are Normal

At any given time, drawdowns of 10-15% are within expected ranges, with larger drawdowns possible at the peak of a trading cycle or during suboptimal market conditions. These temporary declines in account value are a natural part of trading and do not indicate system failure. The position trading strategy and cyclical nature of EPIC’s approach may contribute to short-term fluctuations as the AI navigates all market conditions to secure advantageous positions.

Losses on Individual Trades Are Expected

EPIC’s strength lies in generating positive returns over many trades, not in winning every single one. The use of multiple entries and exits, combined with the cyclical push for maximum gains and varying market conditions, means some trades—particularly at cycle peaks or during disrupted market structures—may close at a loss as part of the broader strategy to achieve an optimal position. These losses are integral to the system’s calculated and adaptive approach.

Long-Term Advantage

The software’s AI is engineered to deliver a mathematical edge, ensuring profitability over extended time frames when used as intended. By leveraging the inherent mathematics of markets, sophisticated position management, continuous learning, and best-in-class risk management, EPIC achieves consistent, elite performance. The system is designed for the long haul, targeting annual returns of 80% or higher, though results depend on market conditions, user settings, and the cyclical phase.

Key Tip

Avoid focusing on daily or weekly results, as short-term fluctuations, cyclical peaks, and varying market conditions are expected. Instead, review your performance on a monthly or quarterly basis to align with EPIC’s long-term, position-based, and cyclical strategy. Trust the AI’s calculated, adaptive, and risk-managed approach, even when short-term market moves, cycle transitions, or market structure disruptions seem unexpected. When planning account changes, such as starting, adding, or removing funds, consider consulting with your EPIC representative to discuss the current cycle phase and market conditions.