Performance Report

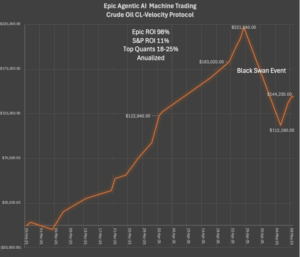

WTI Crude Oil Futures CL – Velocity Protocol

Live Trading Results: Feb 25 – May 8, 2025 | $1M Account

Introduction

Epic Agentic AI is a cutting-edge autonomous trading platform powered by self-learning AI agents that optimize trading strategies in real time. Designed for accredited investors and institutional funds, our system leverages deep reinforcement learning, multi-agent collaboration, and ultra-low latency execution to deliver consistent, high-risk-adjusted returns across global markets.

Now spans 27 financial instruments (stocks, commodities, crypto), delivering baseline expected 80%+ annualized returns (https://epicaihub.io/epic-agentic-ai-white-paper/).

Autonomous decision-making processes 9,300+ weighted decisions instantly, adapting to real-time market shifts.

Clients retain full custody of funds and opt-in/out control, ensuring transparency and trust.

EPIC IDENT™ Order Flow and 300+ custom models enable tailored strategies for diverse accredited investors and institutional fund portfolios.

Scalable for account sizes ($200K–$50M+ for crude oil futures), accommodating varying accredited investors and institutional funds needs.

Custom tailored innovative, high-performance solutions, outpacing competitors using static models ([PwC, 2025]).

Enhance operational efficiency by automating trade execution and compliance, freeing resources for client relationships.

Positioned as a market leader with EPIC’s 2025 private equity deployment and 2026 public market expansion.

Firms without AI risk losing clients to tech-forward competitors in volatile markets ([AdvisorHub, 2025]).

Actual Trading Results

Epic Agentic AI leverages self-optimizing Agentic AI to conquer volatile markets, starting with crude oil futures. Our system outperforms top quant funds by 4–5x (currently on pace for 98% annualized ROI as of May 8, 2025) while maintaining elite risk control (Sortino 10.74)—blending venture capital returns with the safety of Treasury bonds

Performance Highlights (as of May 8, 2025)

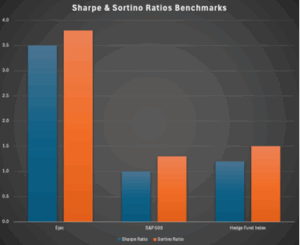

| Metric | Epic AI | Top Quant Funds | S&P 500 | Epic vs. Benchmarks |

| Annualized ROI | 98.0% | 18–25% | 10–12% | 4–5x higher returns |

| Sharpe Ratio | 11.7 | 3.0–3.5 | 0.8–1.2 | 3.3x more efficient |

| Sortino Ratio | 10.74 | 3–5 | 0.8–1.2 | 2–3x better downside control |

Results

Metrics

| Metric | Epic AI | Top Quant Funds | S&P 500 | Epic vs. Benchmarks |

| Win Rate (Sequences) | 88.4% (61/69) | 55–65% | Approx 63% of months have positive returns since 1999 | 23% higher win rate |

| Win/Loss Ratio | 7.6:1 | 1.5:1 – 5:1 (varies) | 0.63:1 (approx.) | Consistency in wins |

| Max Drawdown

|

-9.0% | -10–15% | -49% (2000), 33% (2020), 27% (2022) | Elite risk management and backfill protocol to rapidly make back losses |

| Avg Loss (Sequences) | -0.6%* (excl. 9% outlier) | -2–3% | -4-5% (average drawdown in a red month since 1999) | 5x smaller losses |

| Profit Factor | 2.09 | >2 is a robust strategy |

* Average of the 7 other losing sequences not including the -9% loss (all <1%).

| Excess Returns | Epic AI | T-Bills | S&P 500 | Epic vs. Benchmarks |

| 72-Day Return | 14.42% | 0.97% | 9.42% | Same risk higher returns |

| Annualized Return | 98% | 5% | 11% | Lower Risk Higher Returns |

Max drawdowns and ROI on an account depend on how much margin is available per contract. Adjustments can be made to both based on an investor’s risk tolerance. Sample size remains small as of May 8 as we continue our live data gathering.

Competitive Positioning

We combine the high returns of venture capital (98% annualized) with the risk profile of Treasury bonds (Sortino 10.74). Even with the 9% drawdown in early May, our Sharpe of 11.7 is unmatched in institutional finance.”

Execution and Risk Metrics

| Metric | Epic AI | Comment |

| Days/Trade | 5.03 | |

| Average Hold Time | 902 Minutes | |

| Fill Rate | 100% | |

| Market Impact | $500M | Conservative estimates suggest $500M AUM with no decay |

| Volatility | ~27% | ** |

| Leverage | Futures contracts | Leverage is built into the futures contract and has several variabilities |

** Epic Agentic AI’s estimated annualized volatility is ~27%, reflecting its aggressive alpha generation. Controlled by a Sharpe Ratio of 11.7 and max drawdown since the introduction of agentic AI of 9.0%, it balances risk/reward for accredited investors. **