Note: Article below is mirrored directly from Medium article found here.

Introduction

The act of identifying a need and offering a solution through exchange was an early spark of human economic creativity. Trading is more than just a transaction — it is the heartbeat of life’s evolution. Long before spreadsheets and order books, all living systems, from the roots of plants to the pulse of ancient cities, operated through exchanges that propelled survival, adaptation, and growth. Trade is not an invention, but an extension of a primordial rhythm — an energetic flow that transforms necessity into progress, forging the paths of civilization.

Trading: The Deep Roots of Exchange

Trading is far more than an economic practice — it is a manifestation of a foundational process that permeates all levels of life and the universe.

Trade and Mutualism in Nature

In the natural world, mutualistic exchanges are vital to survival and ecosystem resilience. For example, plants trade carbohydrates with mycorrhizal fungi in exchange for nutrients and water, forming expansive underground networks that benefit both partners.

“Mutualisms — interactions between species that provide reciprocal benefits — are a driving force in evolution and ecology, with mycorrhizal fungi–plant interactions among the most essential and widespread.”

(Bronstein, J.L., 2009, The evolution of mutualism, PubMed/Nature Reviews Genetics)

Exchange as a Universal Physical Principle

At the most fundamental level, the universe itself operates through exchange. All forces known to physics — from electromagnetism to gravitation — are described as interactions involving the transfer of energy, momentum, or other properties.

“Fundamental interactions are processes by which elementary particles exchange energy and change state… forming the basis for all the forces in nature.”

(Wikipedia: Fundamental interaction)

Social Reciprocity: The Roots of Human Trade

In human societies, trade formalized the principle of reciprocal benefit that is observed in nature and physics. Exchanging goods, ideas, or services is at the heart of economic and cultural evolution, making cooperation and specialization possible.

“Biological markets provide a framework for understanding how individuals trade commodities, negotiate cooperation, and adjust strategies based on supply and demand, much like human economies.”

(Hammerstein, P. and Noë, R., 2022, Biological trade and markets, Springer/Philosophy of Science)

Milestones: The Historical Arc of Trading

Human history is, in many ways, the story of trade. Some of the world’s most pivotal moments were born at trading crossroads:

- Ancient Sumer & the Advent of Writing: Around 3500 BCE, Sumerians in Mesopotamia invented cuneiform writing — initially to record trade transactions. This leap allowed civilizations to track assets, debts, and agreements, providing stability and scale.

- Babylon & Commercial Law: The Babylonians institutionalized commerce, developing early banking systems and comprehensive codes for contracts, further enabling complex trade networks.

- The Silk Road & Global Links: Trade routes connected East and West, moving not just silk and spices but ideas, religions, and technologies — showing trade’s role as a diffuser of progress.

- Opium Wars & Colonial Hegemony: In the 19th century, the British Empire’s trade policies — and ensuing conflicts like the Opium Wars — reshaped economies and destinies, underlining how trade could trigger epochal shifts.

- The Rise of Stock Exchanges & Globalization: From Amsterdam’s 17th-century exchange to today’s digital platforms, the mechanisms of trading became faster and more open, re-configuring who could participate and innovate.

Trade, again and again, has altered the fate of nations and individuals — its reverberations can be felt in every era’s turning point.

https://en.wikipedia.org/wiki/Timeline_of_international_trade

The Cycle of Civilizations and Markets

Patterns of growth, peak, and decline are woven into the very fabric of civilization, and these cycles often mirror those of the natural environment. Earth itself experiences climatic phases, such as the Medieval Warm Period and the Little Ice Age, that have dovetailed with eras of prosperity and periods of hardship in human societies.

Historically, civilizations rose as trade expanded and innovations flourished — only to face decline when resources dwindled, climates shifted, or external competition intensified. Empires from Rome to the British and Dutch expanded on the tides of commerce, projecting influence across continents.

Compression in the Last Century: Civilization at Fast-Forward

Yet in the last hundred years, the pattern has undergone dramatic “compression” — the time between periods of growth, dominance, peak, and decline has rapidly shortened. Where ancient empires or market eras once lasted centuries, today’s advances can catapult nations, industries, or companies from ascendance to obsolescence in mere decades, sometimes even years.

This historic compression is driven by several key forces:

- Technological Advancements: Innovations such as the telegraph, telephone, internet, and now artificial intelligence have eliminated geographic and temporal barriers. Information and capital now move instantly across the globe, accelerating both opportunity and disruption.

- Market Integration: Globalization has fused what were once isolated economies into a single, highly reactive network. Economic shocks, booms, and crises transmit worldwide in moments, amplifying both growth and volatility.

- Acceleration of Innovation: Breakthroughs now build upon each other exponentially. For example, Moore’s Law in computing shows how technological progress stacks rapidly, making competition more intense and strategic cycles shorter.

- Financialization and Speed: The rise of complex derivatives, leveraged financial products, and high-frequency trading means that market bubbles and corrections can form and burst at unprecedented speeds.

Consider that the average lifespan of a company on the S&P 500 has plunged from about 60 years in the 1950s to under 20 years today. Economic renaissances like Japan’s postwar rise, the tech boom in Silicon Valley, or China’s leap after the 1980s have unfolded at a breakneck pace compared to earlier hegemonies. Recent market crises — such as the 2008 financial collapse or the COVID-19 freefall and rapid recovery — played out in days or weeks, not years or decades.

Compression reflects an era in which cycles of growth, dominance, decline, and renewal are happening faster than ever before. For traders and innovators, this means heightened risks but also extraordinary opportunities: the future belongs to those who can recognize and adapt to accelerating change.

The Digital, Crypto & AI Trading Revolution

The past century marks a quantum leap in the evolution of trading. Communication technologies and digitization have dissolved physical borders, enabling transactions in milliseconds across the globe. The introduction of computers, the internet, and sophisticated algorithms transformed trading from floor shouting to silent streams of code executing billions in value each second.

More recently, artificial intelligence and quantum computing have redefined what’s possible. Markets today are arenas of data — an environment where edge belongs to those who can extract insight and act at lightning speed. The rise of digital platforms, algorithmic strategies, and AI-driven decision-making is not simply an upgrade; it is a paradigm shift. Trading has become a science of anticipating, adapting, and mastering information flow — ushering us into a new era.

The Crypto Revolution: Blockchain and Digital Assets

Within this digital revolution, the rise of cryptocurrency and blockchain technology represents another paradigm shift. Blockchain enables trustless, peer-to-peer exchanges via distributed ledgers, decentralizing control and adding transparency and security to financial systems. Since Bitcoin’s launch in 2009, digital assets have multiplied, from smart contract blockchains like Ethereum to DeFi protocols reshaping lending, trading, and investing.

“Blockchain is a disruptive technology that — when deployed responsibly — can empower users, reduce corruption and increase trust. Cryptocurrencies built on distributed ledger technology (DLT) have emerged as potential gateways to new wealth creation and disrupters across financial markets.”

— World Economic Forum, What is blockchain and how does it work?

Crypto markets operate 24/7 on a global scale, creating unprecedented conditions for automation and real-time data-driven trading. Algorithmic and AI-powered models are now as common in crypto as in stocks or forex, managing high-frequency trading and responding instantly to new information.

“Algorithmic trading, which relies heavily on programmed instructions, already dominates global markets. It accounts for 60%-73% of equities trading on U.S. markets, 60% in Europe and 45% in the Asia Pacific”

— Benzinga, What Percentage of Stock Trades Are Made by Bots and Algorithms?

Major trading platforms are expanding their focus to include cryptocurrencies, combining the adaptive power of AI with the transparency and programmability of blockchain. The convergence of AI and crypto signals a future financial ecosystem that is globally accessible, continuously evolving, and increasingly autonomous.

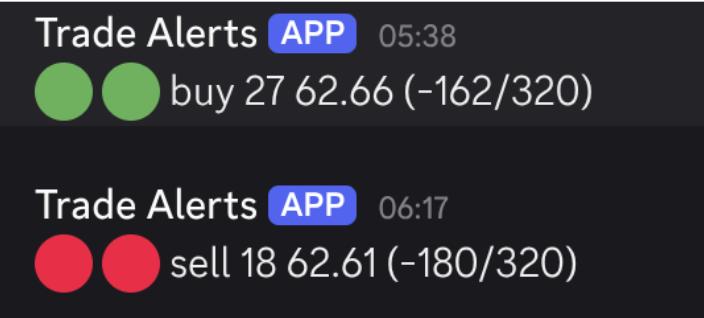

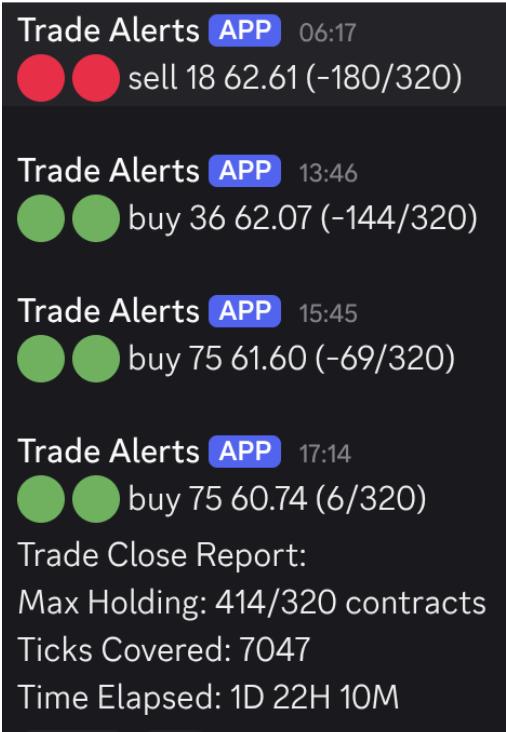

Case Study: EPIC Agentic AI as the Final Stage

Few innovations capture this final evolutionary stage like EPIC Agentic AI. Emerging from the competitive crucible of crude oil futures, EPIC was engineered to do more than automate trades — it was designed to autonomously evolve, outthink, and outperform in the world’s most volatile arenas.

1. Origins and Core Philosophy

Developed since 2016, EPIC AI started with the vision of mastering unpredictable markets. The foundational breakthrough was the integration of Agentic AI — enabling the system to autonomously adapt and refine its tactics in real time. As a result, EPIC quickly scaled beyond oil into equity indices, cryptocurrencies, and more.

2. Architecture: Swarms and Self-Learning

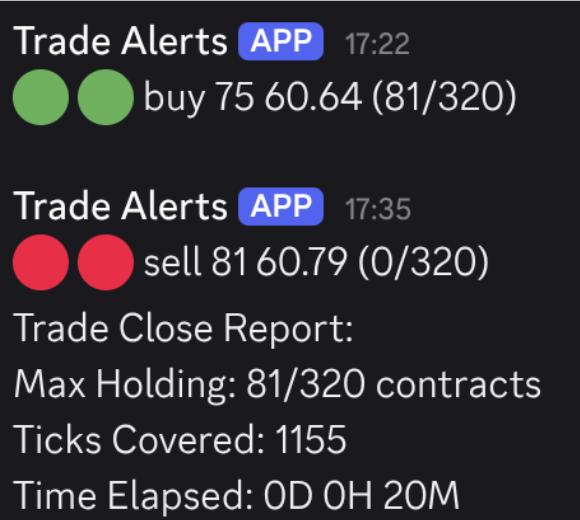

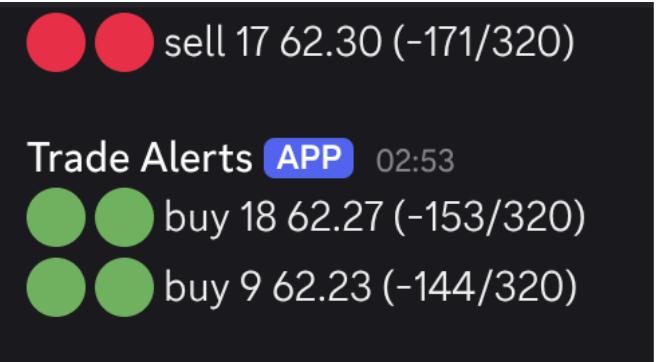

At the heart of EPIC’s edge is its multi-agent “swarm” architecture. These autonomous agents specialize in everything from market selection and order flow analysis to risk management. The system is continuously trained — subjected to extreme simulated and real-world conditions — to expose, then eliminate, any weakness. Retraining, reinforced learning, and deep learning techniques fuel continuous improvement. EPIC’s proprietary models weave together more than 300 algorithms, validated by years of live and historical data.

A defining feature — EPIC IDENT™ — acts as a real-time order flow intelligence system. It tracks the behavior and “fingerprints” of market participants (especially automated trading systems), using historical patterns, volatility, and liquidity dynamics to predict and capitalize on price movements. EPIC IDENT™ is a live, adaptive successor to back-testing — foreseeing pivots as they emerge.

3. Risk Controls and Performance

Risk management is foundational. The system enforces strict drawdown limits, utilizes multi-layered checks, and dynamically adjusts position sizes. Results speak for themselves: win/loss ratios exceeding 7:1, consistent annualized returns, and robust out-performance of legendary funds like Simons’ Medallion, Lynch, and Buffett.

Who Is Jim Simons?

Jim Simons is a renowned mathematician and investor. Known as the “Quant King,” he is the founder of Renaissance…

www.investopedia.com

4. Scientific Foundations and Innovation

EPIC’s conceptual roots in mathematical physics — in particular, the 3–6–9 pattern found in string theory and quantum teleportation — inform the structural elegance of EPIC’s architecture. Just as string theory suggests hidden dimensions and interconnectedness, EPIC’s multi-layered system synthesizes data across timecycles and market states, acting as a hyper-dimensional map for trading opportunity.

What Sets EPIC Apart

EPIC isn’t just another quant system — it heralds a new era. Its full autonomy, relentless self-optimization, and capacity for risk-controlled alpha generation place it ahead of traditional quant and even the most sophisticated high-frequency trading desks.

The ecosystem is decentralized: clients maintain custody and control, using EPIC as a plug-in to their existing accounts — no pooled funds, no opaque management, just transparent, user-driven AI execution. Its modular architecture allows for easy scaling and cross-asset deployment.

EPIC’s approach is emblematic of where finance is headed: Agentic, adaptive, and democratized for those able to harness advanced intelligence.

Conclusion: The Future of Trading — Cycles, Intelligence, and Autonomy

From the primal energy exchanges of the natural world to the neural nodes of AI agent swarms, the story of trading is one of perpetual evolution. Each epoch — each technological leap — compresses time, increases complexity, and rewards those who can read patterns in the chaos.

EPIC Agentic AI stands at the frontier, synthesizing history, science, and innovation into a living testament of what trading can become: fully autonomous, risk-aware, and ever-evolving. As we enter a new era, the question isn’t just how we will trade — it’s how we will evolve alongside these intelligent systems, riding the next great cycle in the relentless march of progress.

References

- Foundations of Trade and Scientific Insight

- Bronstein, J.L. (2009). The evolution of mutualism, Nature Reviews Genetics.

- Fundamental interaction (Wikipedia)

- Hammerstein, P., & Noë, R. (2022). Biological trade and markets, Philosophy of Science.

- Timeline of international trade (Wikipedia)

On Agentic AI, Quantitative Finance, and Industry Impact

- Adnan Masood. (2023). The Agentic Imperative Series, Part 5: Return on Investment of Agentic AI. Medium.

- Agentic AI is here. Are business leaders ready? | CFO Dive

- Quantifying the Opportunity Value of Agentic AI | WillowTree

- ROI and Business Value of Agentic AI | Aisera

- The AI Tipping Point — Basware News

- Generation AI in Asia Pacific | Deloitte Insights

- UPS and Agentic AI: A Case Study in Logistics Innovation | The CDO TIMES

EPIC Agentic AI — Official Resources and Deep Dives

- EPIC AI Official Website

- The Dawn of EPIC: A Trading Revolution Powered by Agentic AI

- How We Train AI Agent Swarms to Trade

- How EPIC Agentic AI Trading Software Wins at Oil Trading with Strategic Precision

- EPIC’s Backfill Protocol — The Ultimate Risk Mitigation Revolution in Agentic AI Trading

- EPIC IDENT: Harnessing Agentic AI for Real-Time Trading Intelligence

This article is for informational purposes only and does not constitute financial or investment advice.